Other members of EA Group

Commodities Research House of the Year

At Energy Aspects, we blend world-class human insight, proprietary data analytics, and cutting-edge technology to deliver trusted, real-time intelligence across global energy and macro markets.

Hear views from expert analysts and network with other industry leaders at exclusive Energy Aspects events. Hosted at venues around the world and available both in person and online, take advantage of multiple events and webinars throughout the year.

February 23–24, 2026 | Washington, D.C.

Energy Aspects Conference 2026 will bring together industry, policy, and political leaders in Washington, D.C. for exclusive insights, high-level networking, and a commemorative dinner marking a decade of transformation in the U.S. energy landscape.

We empower traders, analysts, and decision-makers across physical and financial markets - including energy companies, commodity traders, financial institutions, corporates, and governments—with trusted, timely, and granular intelligence.

Our clients rely on our unique blend of analyst insight, proprietary datasets, and technology-driven delivery to improve performance and make better decisions in a rapidly evolving landscape.

Gain access to exclusive analyst access, proprietary datasets, best-in-class analytical tools, and advanced AI - delivering real-time signals and tools that give you an edge.

Stay on top of ever-changing commodity markets with our reports. We provide a combination of deep-dive monthly and weekly reports along with breaking alerts and live content updates as news breaks, allowing you to keep track of market movements.

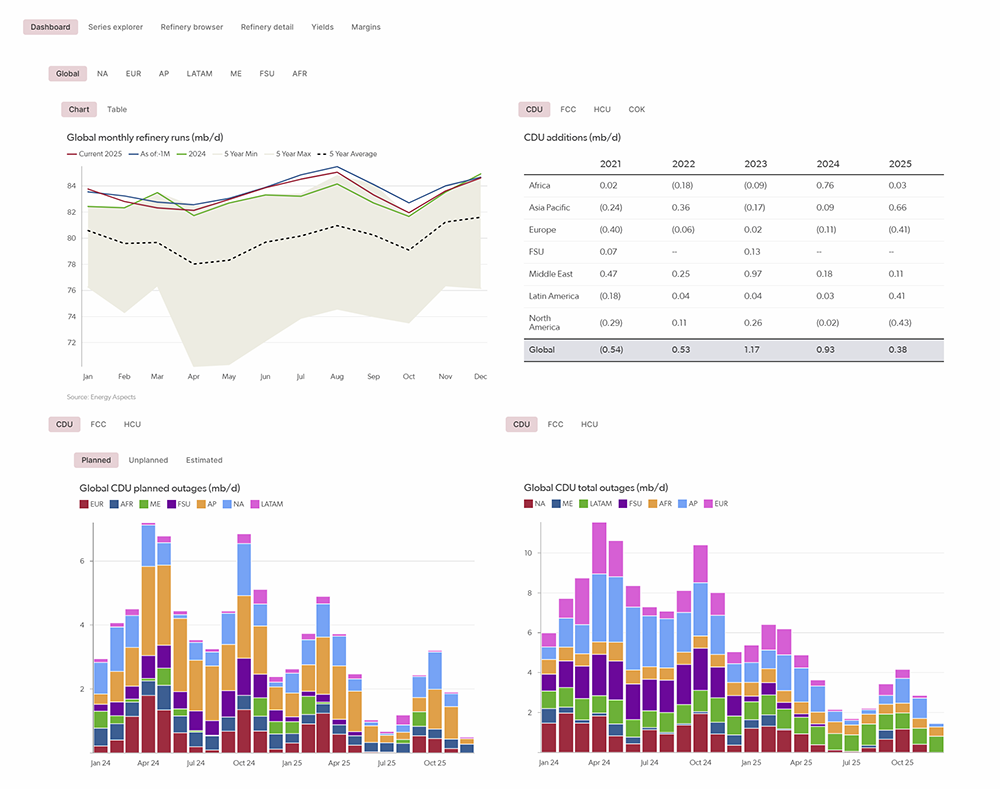

Energy Aspects collects, cleans, processes and publishes data from thousands of sources, allowing you to spend your time where it matters most. Our data analysis tools allow you to visualise, download and access proprietary data.

Access extensive coverage of global commodities markets including supply–demand balances, price forecasts, a range of short-, medium- and long-term outlooks, plus much more.

Comprehensive oil market analysis and insights across the entire petroleum lifecycle, from extraction to refined products and fuels.

Insights into the latest fluctuations in global gas and power supply, demand, transit and policy.

Market analysis, insights and data covering multiple commodity markets and their global implications.

Forward-looking market analysis and data covering the energy transition, emissions and future fuels.