This suite enables traders focussed on commodity markets to quantify macro-financial influences on commodities and incorporate institutional flow dynamics into risk management and trading strategies.

Gain an edge with our Macro Quant insights

Understand how macro regime shifts and institutional flows impact commodity markets for a comprehensive view of market dynamics.

Understand commodity market dynamics

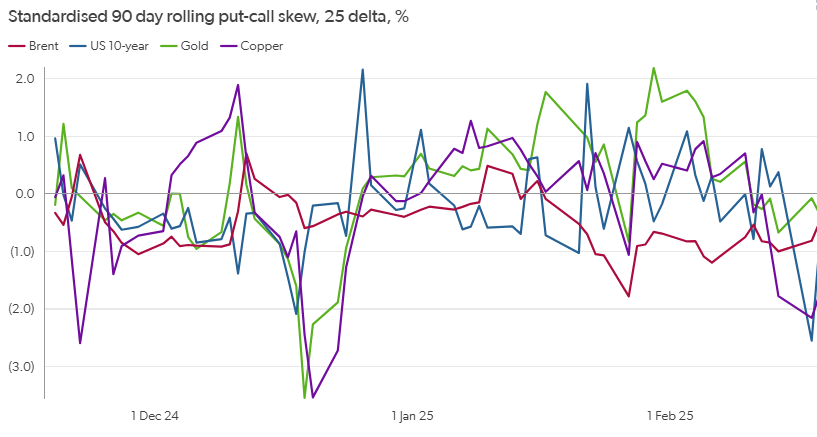

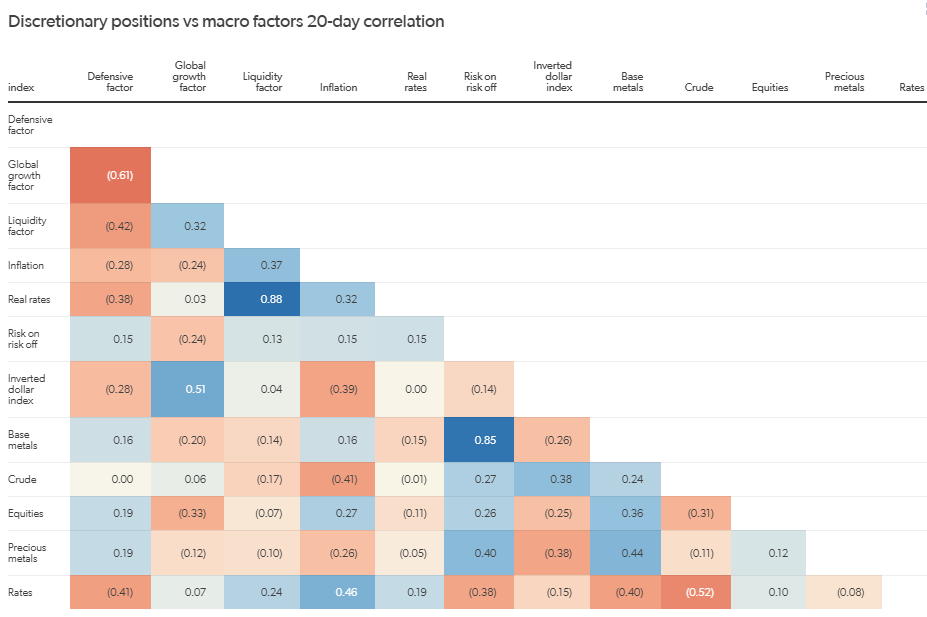

Commodity markets are increasingly influenced by macro regime shifts, institutional capital flows, and cross-asset positioning, alongside traditional supply and demand factors. Understanding how changes in macro markets such as rates, FX, and equities impact commodities provides a more complete view of market dynamics.

How our Macro Quant service can help

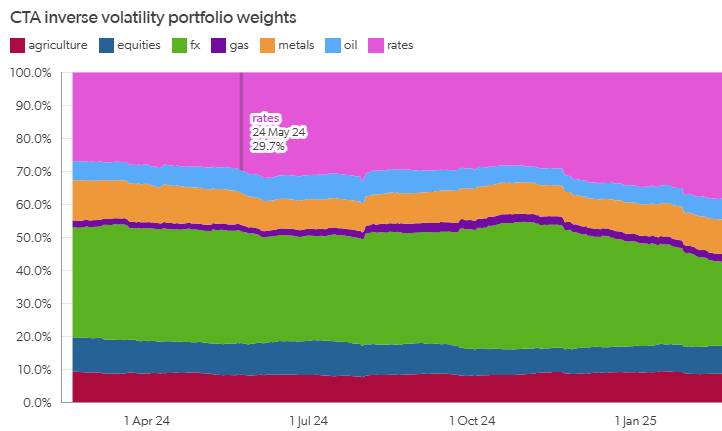

Our Macro Quant analytics suite provides a structured framework for analysing institutional flows, positioning imbalances, and macro-driven risk allocation across asset classes. By incorporating macro regime indicators and financial flow analysis, it helps traders assess the broader market influences on commodity prices.

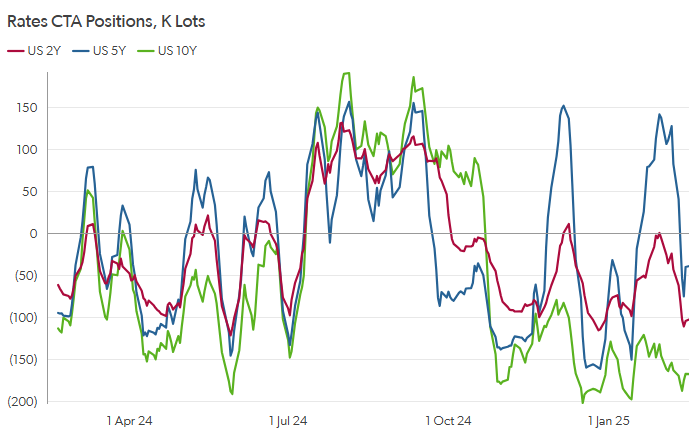

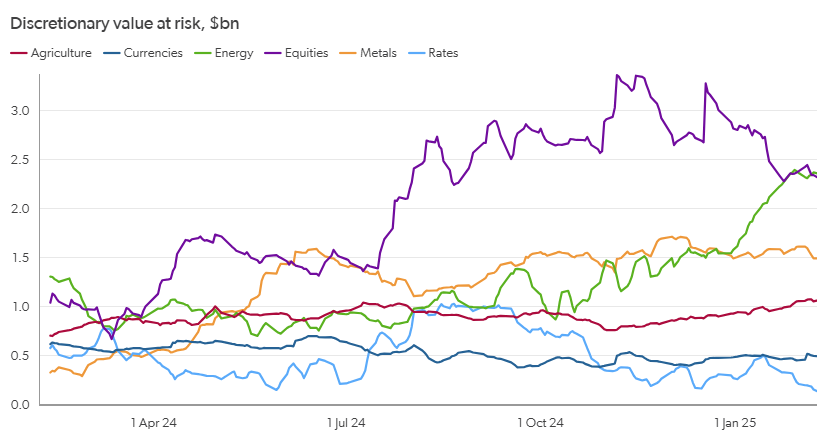

Track cross-asset proprietary metrics and indicators

Analyse financial flows, macro factors, risk measures and their impact on major global markets.

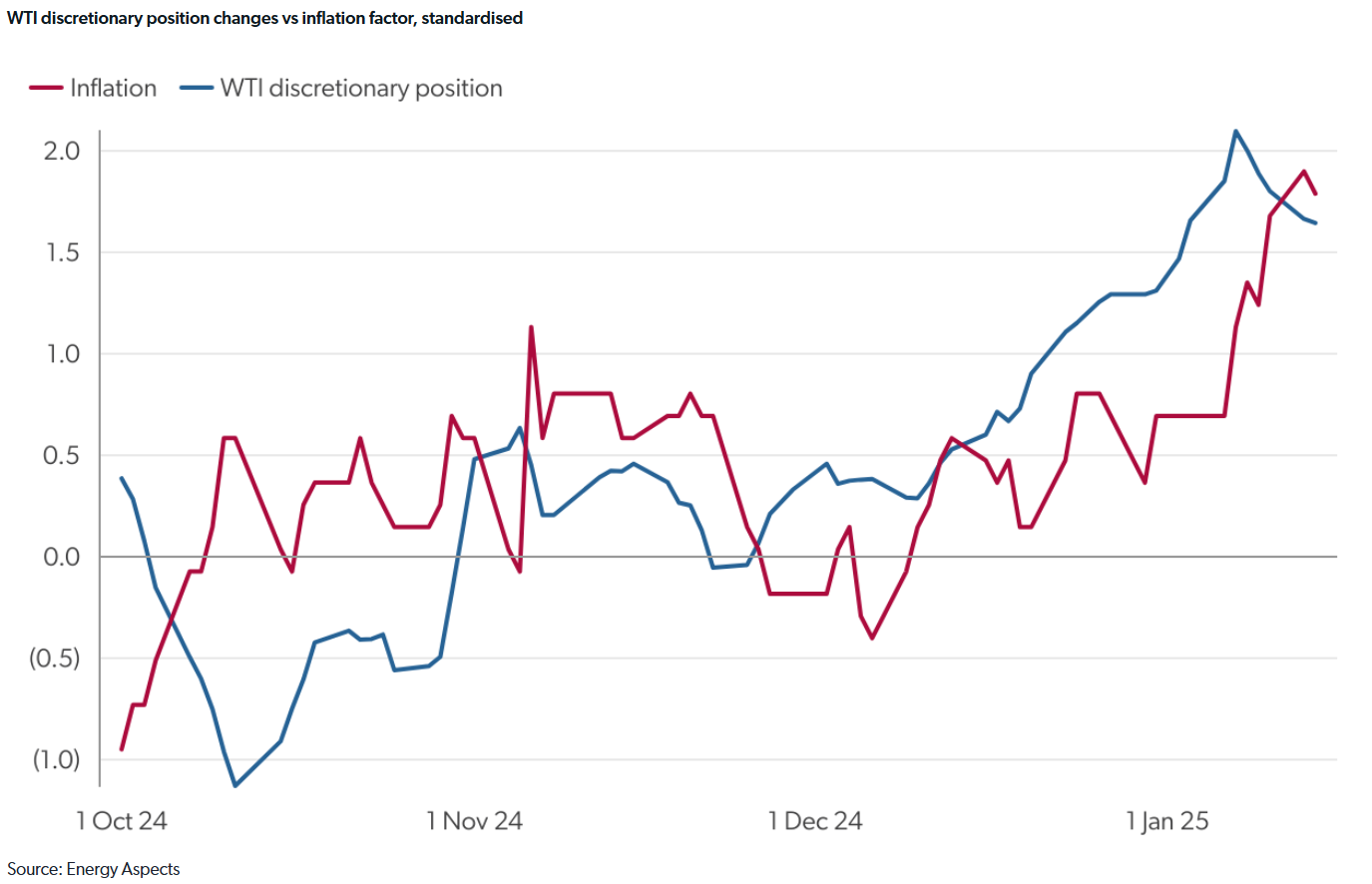

Macro factors

Identify shifts in growth, inflation, and defensive factors to contextualise commodity price movements.

Navigating the Macro Storm

Uncover the indicators that mattered most in a recent cross-asset shakeout and how they can enhance your investment strategy.