Quant Analytics Metals

Applying scientific principles to market-orientated thinking

EA Quant Analytics Metals provides daily analysis of positioning and trade flows in the LME and COMEX Futures and Options markets for multiple categories of market participants.

Metals coverage complements EA Quant Analytics in Energy, Currencies, Rates, and Agriculture, as well as EA Fundamental Analytics in Energy Transition, Freight, Geopolitics, and Macro-Economics.

How this benefits you

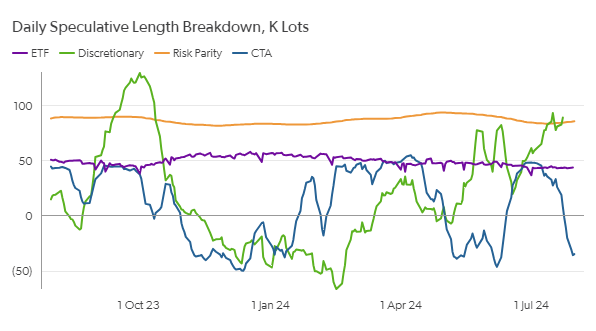

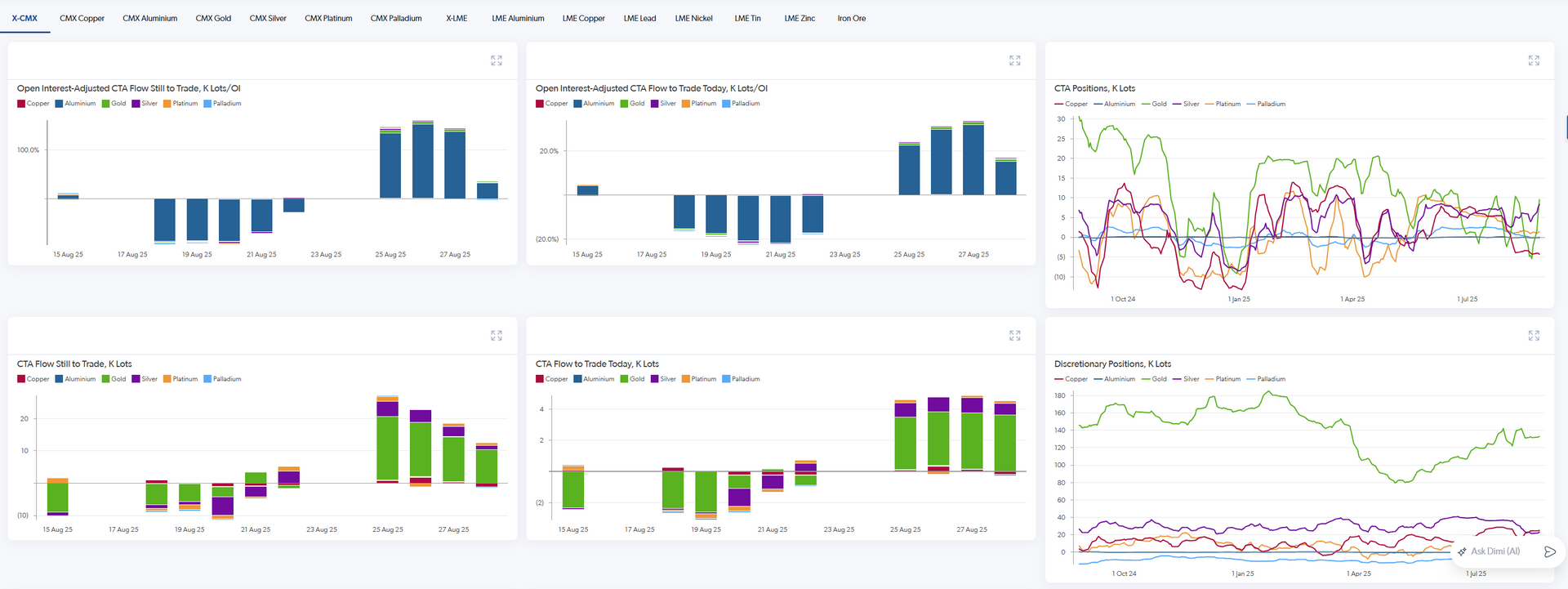

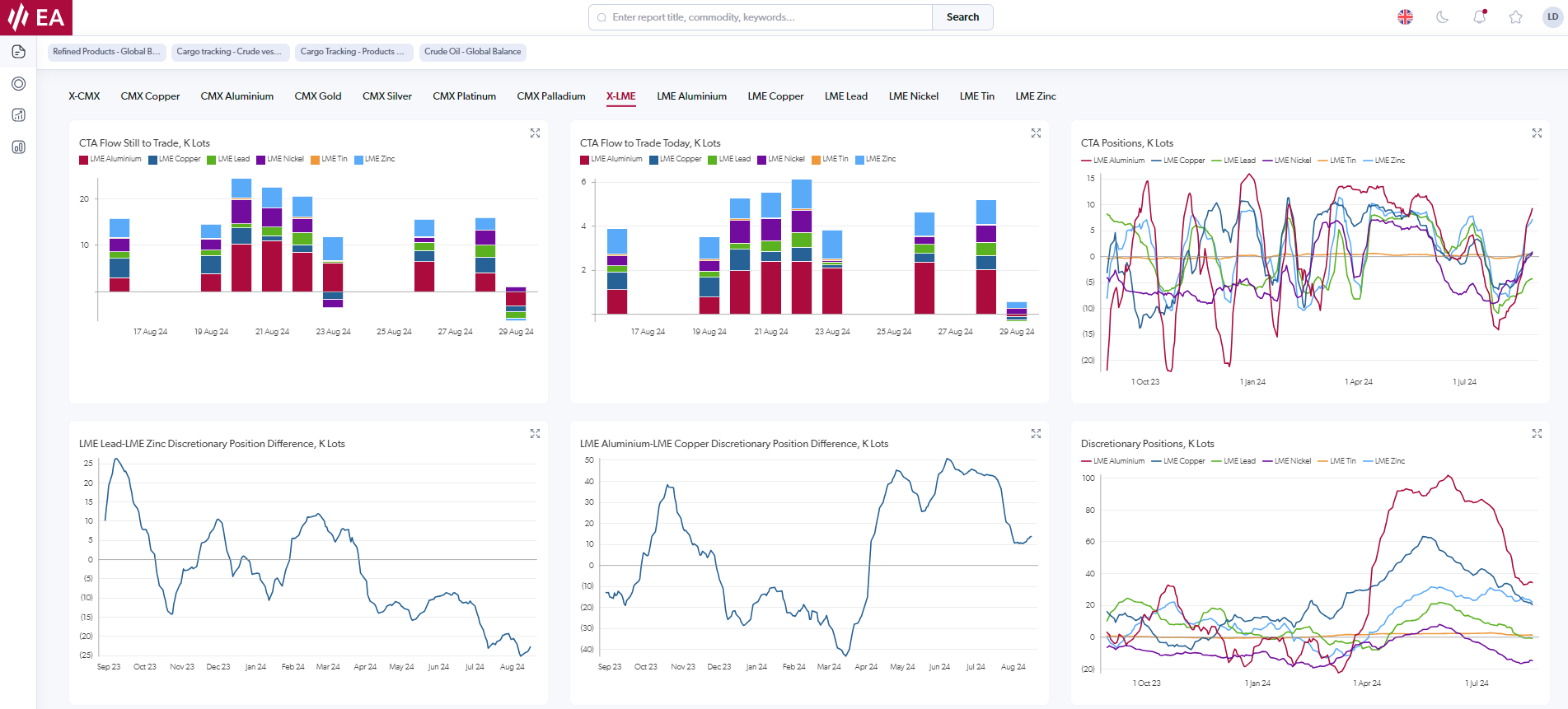

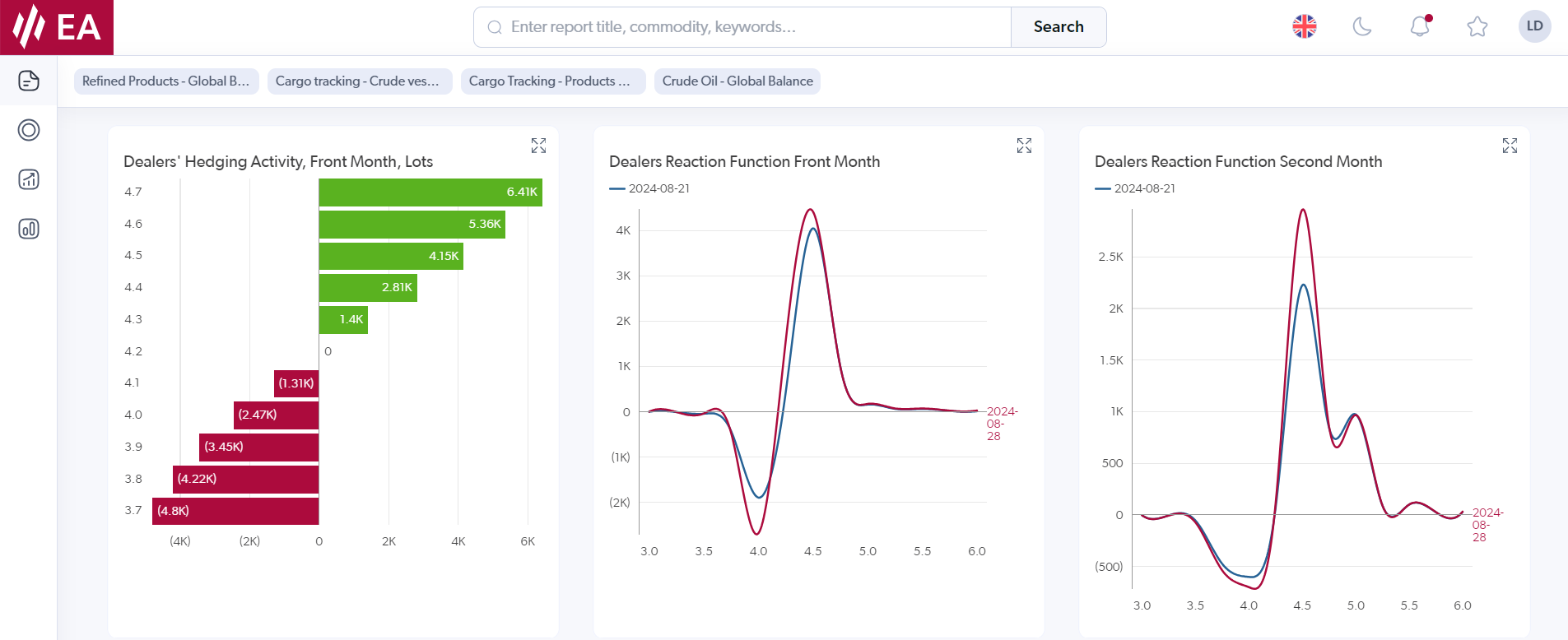

We measure and analyse derivative market positioning and trade flow imbalances to identify:

- Who will be the next marginal participants.

- What and how much will they trade.

- What will cause them to act.

- What will be the potential path outcomes for flat-prices, time spreads, RVs, volatility levels, and other expressions.